Categories

Home PricesPublished July 31, 2025

Palm Beach County Housing Market Trends: Jan 2024 – June 2025

Palm Beach County Real Estate Market Overview

The real estate market in Palm Beach County is shifting. What began as a high-momentum stretch in early 2024 now shows clear signs of cooling by June 2025. Supply is rising, sellers are recalibrating, and buyers are exercising more control. Whether you're watching the trends from West Palm Beach or North Palm Beach, the county real estate market update points to a broader slowdown. Throughout this housing market report, we break down the real estate trends using data from the Florida Multiple Listing Service.

Current State of the Real Estate Market

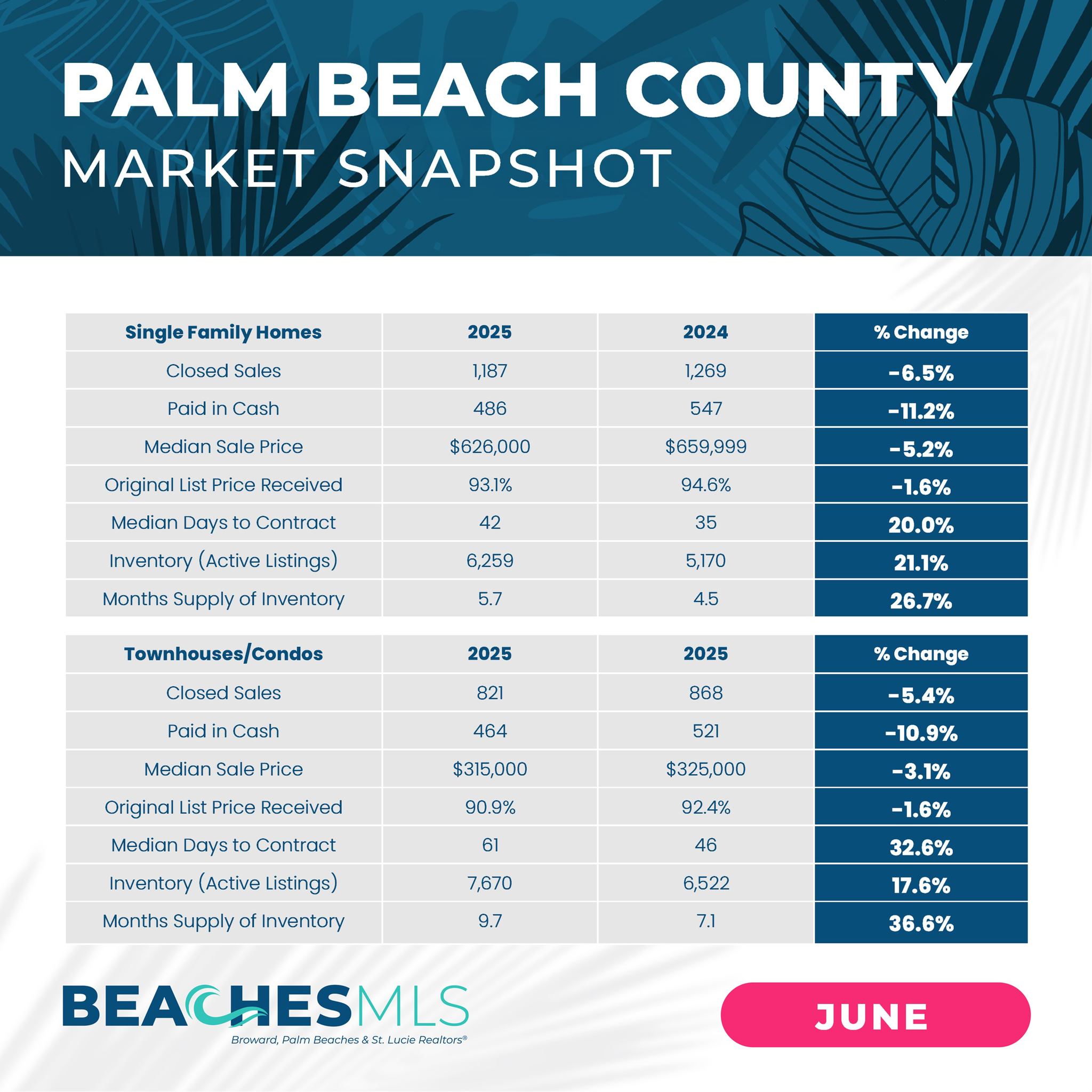

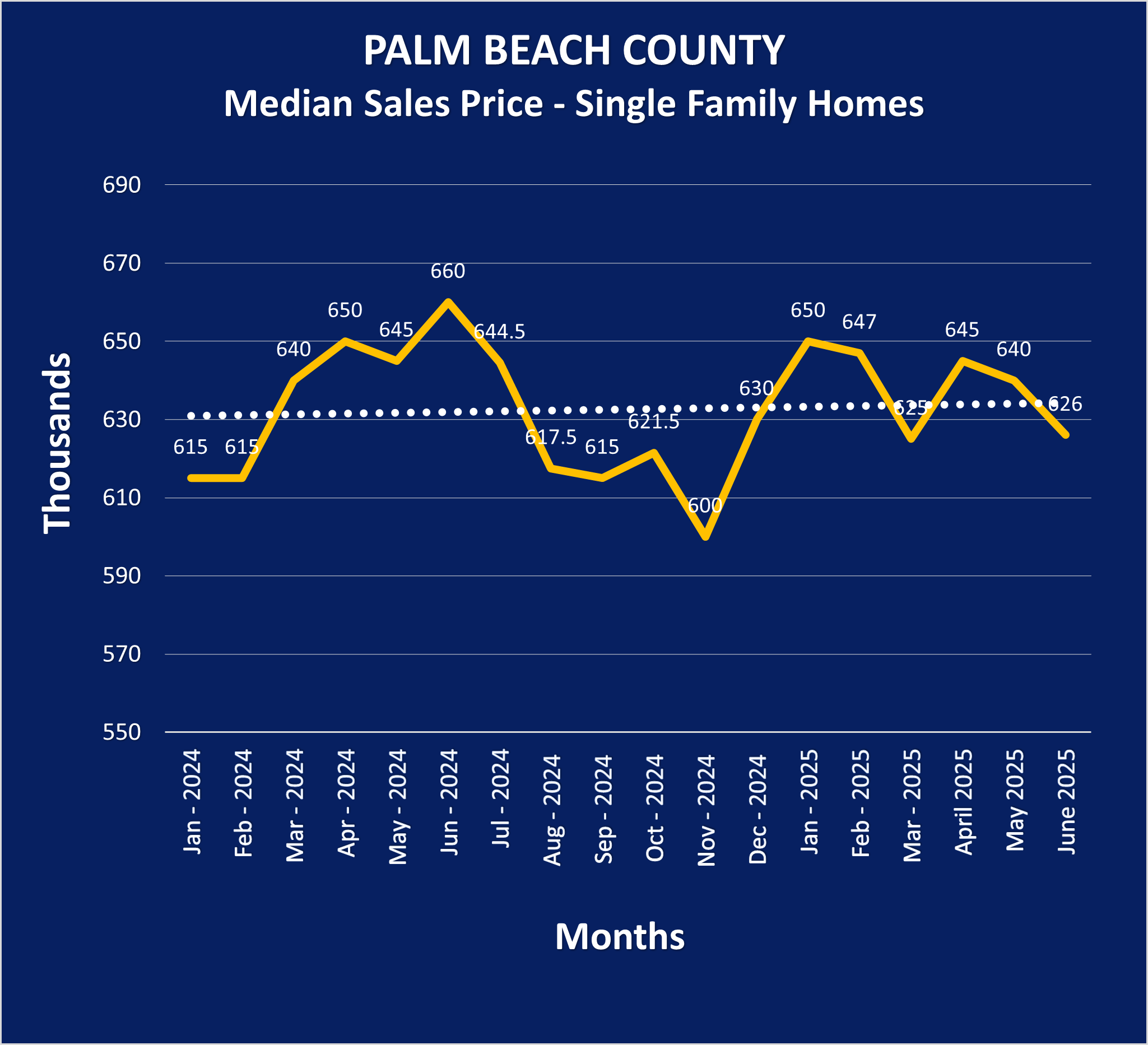

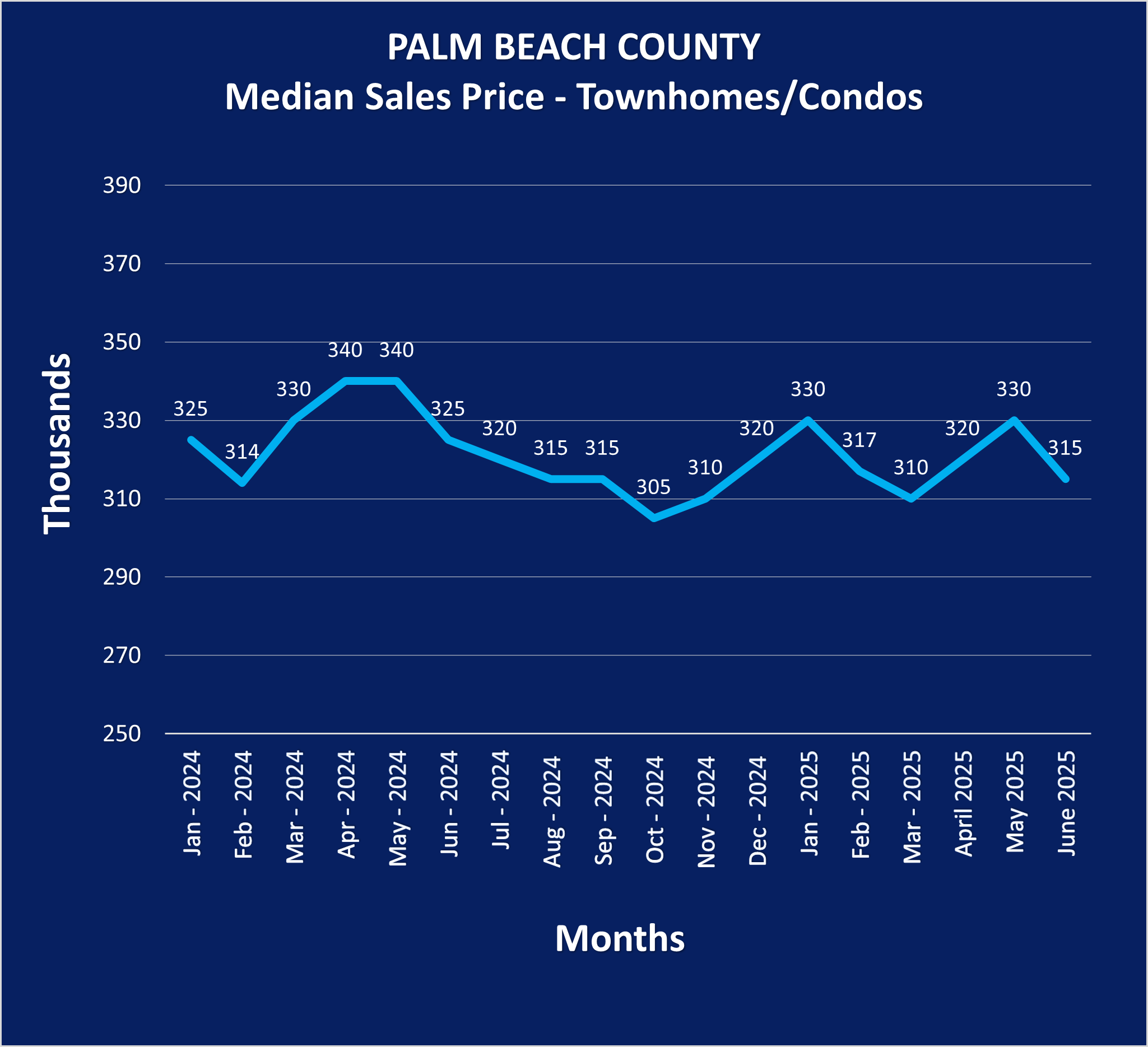

During the early part of 2024, the Palm Beach County housing market was still riding a wave of strong demand. The median home sale price for single-family homes reached $660,000 by June 2024. Palm Beach County townhomes/condos saw similar momentum, peaking at $340,000 in April. But that run has tapered. By June 2025, single-family homes declined to a median sale price of $626,000, and townhomes/condos fell to $315,000.

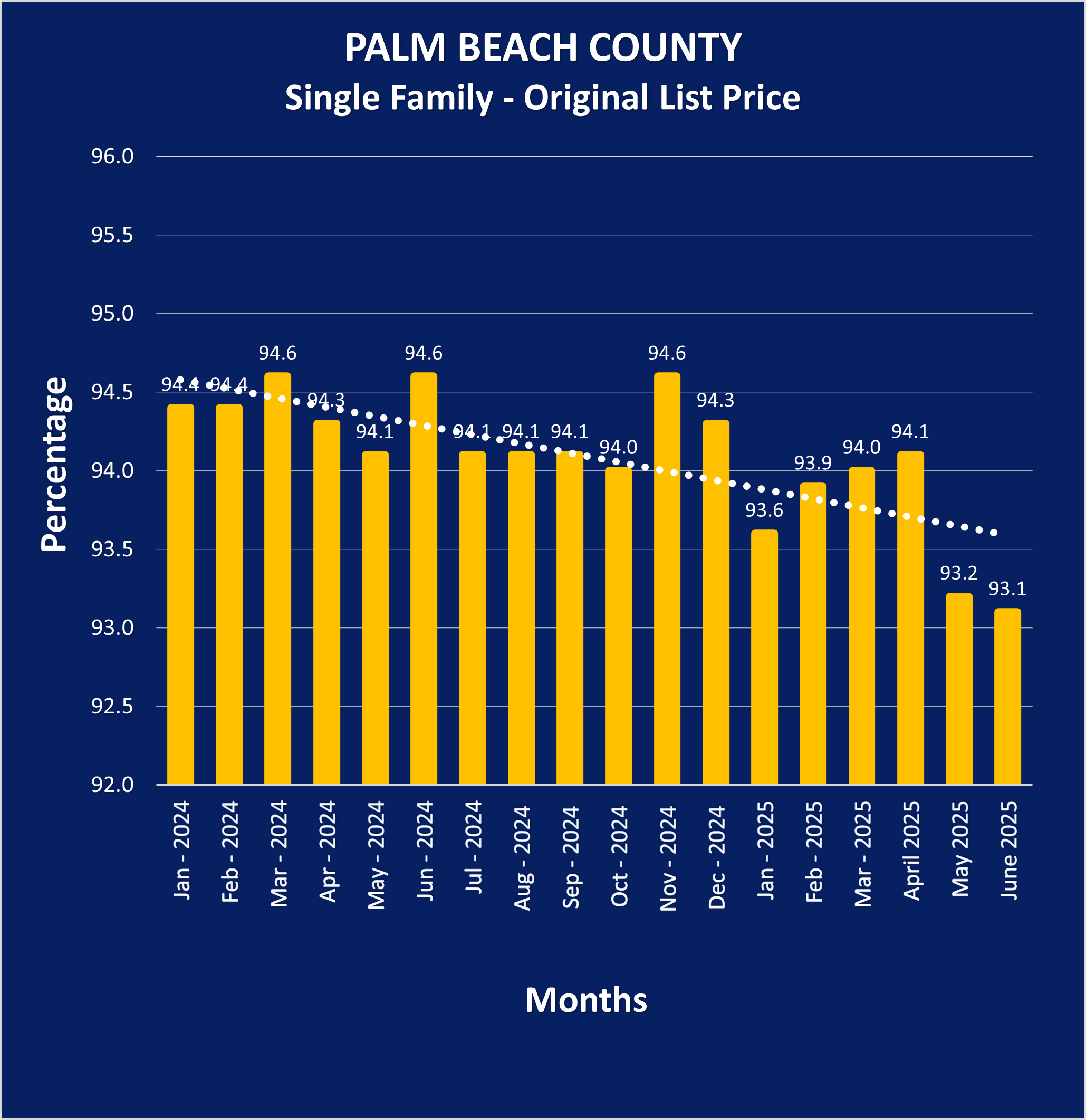

Homes stayed on the market longer, and sellers received smaller percentages of their original asking prices. The average days on market increased countywide, an indicator that the market is shifting toward a more balanced market between buyers and sellers.

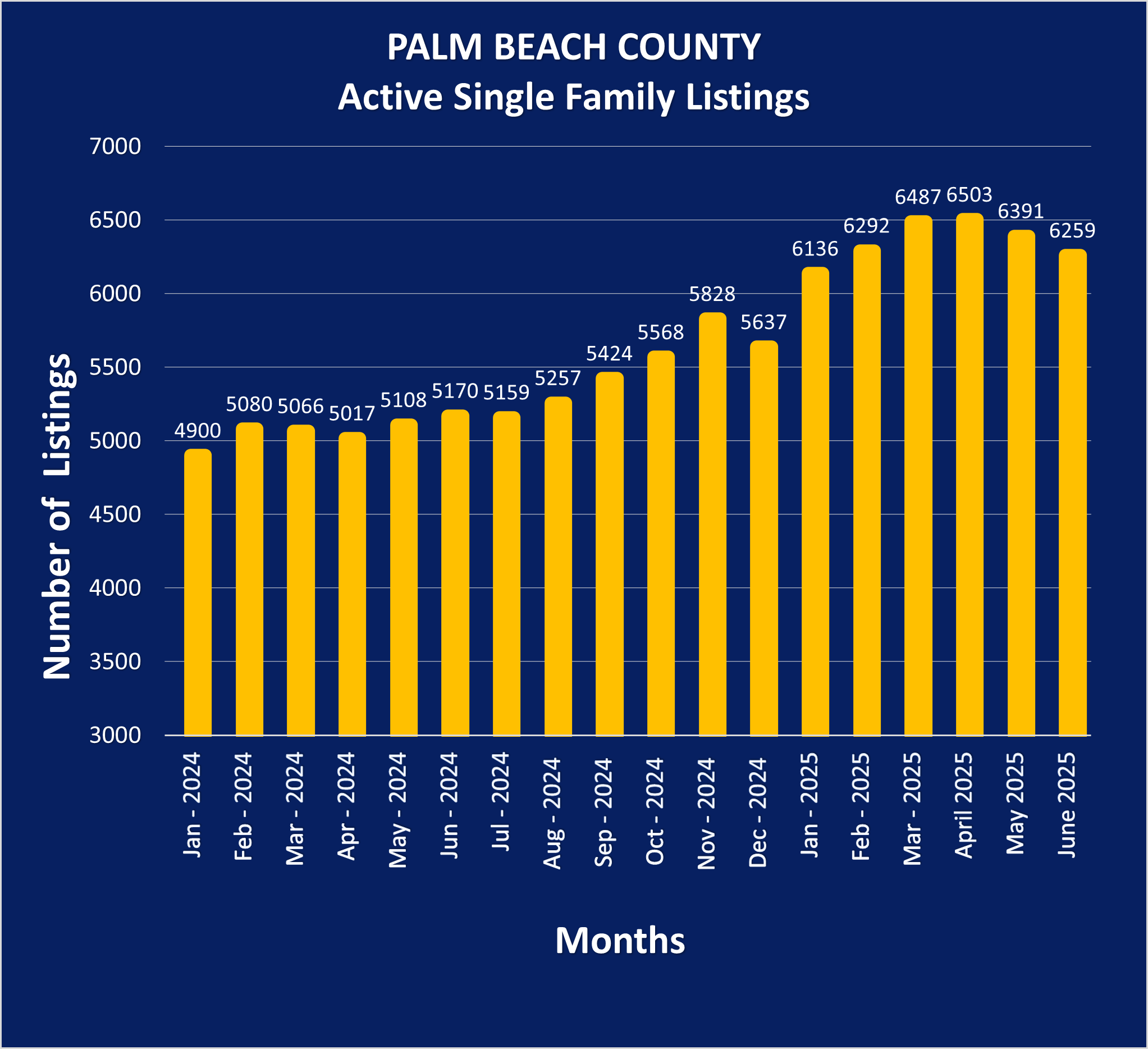

From Royal Palm Beach to Riviera Beach, price increases were common early in the cycle. But by mid-2025, home price growth flattened and, in some sectors, reversed. The months’ supply of inventory expanded across the board. This shift suggests a market for sellers has turned into a more neutral playing field.

Palm Beach County home sales also slowed. Closed sales dropped compared to the year before, while the total dollar volume of real estate sales began to decline. This data supports the case that the Palm Beach County home market is settling after a long run of aggressive appreciation.

Impact of Economic Factors on Market Trends

Higher mortgage rates and inflation continue to influence the Florida housing market. The cost of borrowing has sidelined many would-be buyers. This applies to both homes in northern Palm Beach and across South Florida. Buyers and sellers are adjusting to new realities, including reduced affordability and tighter lending conditions from the Federal Housing Administration.

Single-Family Homes in Palm Beach County

Market Performance for Single-Family Homes

The single-family home market in Palm Beach County performed well through the first half of 2024. Rising demand and a tight supply kept prices high. But starting in late 2024, the supply of inventory increased noticeably. By June 2025, single-family home sales began to show stress, with more homes on the market and fewer bidding wars. A growing number of homes sold below asking price, especially in West Palm Beach and suburban areas like Palm Beach Gardens.

Price Growth and Demand Analysis

Median home sale prices for single-family properties rose early, then hit resistance. As of May 2025, price per square foot had declined slightly, making the area more accessible for buyers. This shift isn’t uniform—some neighborhoods continue to see stronger numbers—but the broader trend indicates a balanced market forming between buyers and sellers.

Days on Market Trends for Single-Family Homes

The average days on market for Palm Beach County homes for sale has increased across nearly every city. From north to south, from Juno Beach to Boynton Beach, homes are sitting longer. Sellers can no longer expect immediate offers. This is especially true for properties that are not move-in ready or that are priced above the local median price.

Townhomes/Condo Market Insights

Current Trends in the Palm Beach County Townhomes/Condo Market

The condo market has softened more aggressively. Inventory levels spiked in many South Florida townhomes/condo buildings, and demand hasn’t kept pace. In places like Riviera Beach and North Palm Beach, the months’ supply of inventory for condos has nearly doubled. Median sale prices fell by 6.1% year-over-year in March 2025 and is almost flat through June.

This isn’t a crash, but it is a noticeable deceleration. Whether looking at two-bedroom investment units or oceanfront residences, the Palm Beach County townhomes/condo market is cooling faster than the single-family segment.

Comparative Analysis: Townhomes/Condos vs. Single-Family Homes

Compared to single-family homes, townhomes/condos are more affected by rising HOA fees, lending restrictions, and investor hesitancy. While both segments are slowing, condos for sale in Palm Beach County are under greater price pressure. Days on market for condos increased by over 30 days, while list-to-sale ratios declined more steeply. Buyers are more cautious, and many are waiting for deeper discounts.

Future Outlook for Palm Beach County Townhomes/Condos

As of this market report, the outlook for townhomes/condos is cautious. Unless there’s a shift in interest rates or a tightening of new construction, buyers will continue to have options and leverage. That said, location still matters. Demand remains resilient in certain high-demand zones, such as Palm Beach Gardens and Boca Raton. But overall, this segment will take time to recover.

Palm Beach County Market Update for 2025

Predictions for Mid-2025 and Beyond

By June 2025, the housing market in Palm Beach County is stabilizing. It's not a seller’s market anymore. Expect modest movement on pricing, longer timelines for home sales, and more back-and-forth negotiations between buyers and sellers.

Real estate trends show that homes in northern Palm Beach and inland markets like Royal Palm Beach will see the most traction if priced competitively. Inventory will likely continue to build, and unless economic conditions improve, this will hold prices steady—or potentially push them lower.

Factors Influencing Future Market Changes

Interest rates and economic policy are the two largest variables influencing real estate trends in South Florida. If rates drop in late 2025, it could spur a late-year rally. But until then, affordability remains a challenge. Investors are keeping an eye on rental demand, while first-time buyers are navigating lending programs from agencies like the Federal Housing Administration.

Advice for Buyers and Investors

For those buying or selling a property in Palm Beach County, the message is: proceed carefully but confidently. Buyers should leverage the expanded inventory and negotiate terms. Sellers should price realistically and be prepared for longer timelines. Investors should look at the median price per square foot and rental yield before pulling the trigger.

Realtor Insights and Expert Opinions

Strategies for Navigating the Market

Agents across Palm Beach County are shifting strategies. In today’s environment, pricing a home right from day one is essential. For listings in competitive areas like North Palm Beach or Palm Beach Gardens, presentation, staging, and digital exposure are more critical than ever. In a balanced market, sellers can’t rely on momentum alone.

Importance of Market Reports for Buyers

Understanding the latest trends in the Florida market helps buyers make smarter decisions. Housing market updates and county real estate market reports offer clarity amid headlines. These reports let buyers assess home prices, understand closed sales, and evaluate where the market is headed based on supply, demand, and average days on market.